Get Pegasystems PEGAPCDC87V1 Exam Practice Questions - Real and Updated

Pegasystems Certified Pega Decisioning Consultant (PCDC) 87V1 Exam Dumps

This Bundle Pack includes Following 3 Formats

Test software

Practice Test

Answers (PDF)

PEGAPCDC87V1 Desktop Practice

Test Software

Total Questions : 184

PEGAPCDC87V1 Questions & Answers

(PDF)

Total Questions : 184

PEGAPCDC87V1 Web Based Self Assessment Practice Test

Following are some PEGAPCDC87V1 Exam Questions for Review

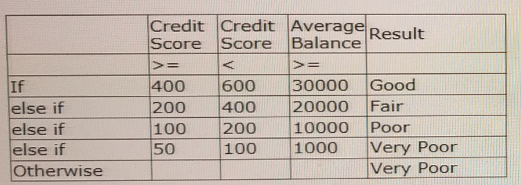

U+ Bank wants to offer credit cards only to low-risk customers. The customers are divided into various risk segments from Good to Very Poor. The risk segmentation rules that the business provides use the Average Balance and the customer Credit Score.

As a decisioning consultant, you decide to use a decision table and a decision strategy to accomplish this requirement in Pega Customer Decision Hub.

Which property allows you to use the risk segment computed by the decision table in the decision strategy?

U+ Bank realizes that customers have ignored a particular mortgage offer. As a result, the bank wants to offer the action 30% more frequently. Which arbitration factor do you configure to implement this requirement?

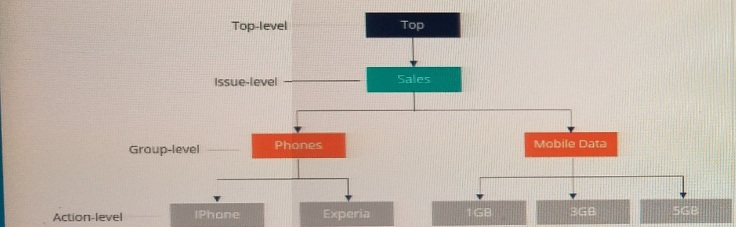

MyCo, a mobile company, uses Pega Customer Decision Hub to display offers to customers on its website. The company wants to present more relevant offers to customers based on customer behavior. The following diagram is the action hierarchy in the Next-Best-Action Designer.

The company wants to present offers from both the groups and arbitrate across the two groups to select the best offer based on customer behavior.

As a decisioning consultant, what must you do to present offers from the two groups?

Reference module: Creating and understanding decision strategies. In a decision strategy, to use a customer property in an expression, you _____.

If the Pega Customer Decision Hub presents Next-Best-Action recommendations to a customer in a call-center, the Next-Best-Action is re-evaluated when _____, ____, and ____ (Choose Three)

Unlock All Features of Pegasystems PEGAPCDC87V1 Dumps Software

Types you want

pass percentage

(Hours: Minutes)

Practice test with

limited questions

Support