Get CIMAPRA19-F03-1 Exam Practice Questions - Real and Updated

CIMA F3 Financial Strategy Exam Dumps

This Bundle Pack includes Following 3 Formats

Test software

Practice Test

Answers (PDF)

CIMAPRA19-F03-1 Desktop Practice

Test Software

Total Questions : 391

CIMAPRA19-F03-1 Questions & Answers

(PDF)

Total Questions : 391

CIMAPRA19-F03-1 Web Based Self Assessment Practice Test

Following are some CIMAPRA19-F03-1 Exam Questions for Review

Company R is a major food retailer.It wishes to acquireCompanyS, a food manufacturer.

Company S currently supplies many storesowned byCompany R withfood products that it manufactures.

Company S is of similar size to Company R but has a lower credit rating.

Whichof the following ismost likely to beasynergistic benefitto R on purchasing S?

A company is concerned that a high proportion of its debt portfolio consists of variable rate finance with an interest rate of LIBOR ' 1 .0%.

It is considering using an interest rate swap to reduce interest rate risk out is concerned about additional finance cost this might create.

A bank has quoted swap rates of 3% 3.5% against LIBOR.

A bank has quoted swap rates of 3% 3.5% against LIBOR.

Is an interest rate swap likely to be beneficial to the company at current LIBOR rates?

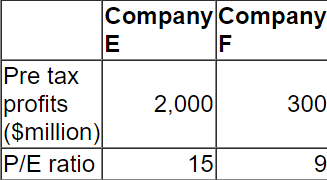

Company E is a listed company. Its directors are valuing a smaller listed company, Company F, as a possible acquisition.

The two companies operate in the same markets and have the same business risk.

Relevant data on the two companies is as follows:

Both companies are wholly equity financed and both pay corporate tax at 30%.

The directors of Company E believe they can "bootstrap" Company F's earnings to improve performance.

Calculate the maximum price that Company E should offer to Company F's shareholders to acquire the company.

Give your answer to the nearest $million.

A manufacturing company is based in CountryL whosecurrency istheL$.

One of the company's products isexportedto Country M, a rapidly growing economy, whose currency is the M$.

In the most recent financial year:

* 100,000 units of the product were sold tocustomers incountry M

* The unit selling price wasM$12

The spot rate today isL$1 = M$5

The companyhas an objective of growth intotalsales value in L$ of 10% a year.

If theL$ strengthens by5% nextyear against the M$, whatvolume of sales of this productisneeded next yearto achieve the objective?

The directors of a multinational group have decided to sell off a loss-making subsidiary and are considering the following methods of divestment:

1. Trade sale to an external buyer

2. A management buyout (MBO)

The MBO team and the external buyer have both offered the same price to the parent company for the subsidiary.

Which of the following is an advantage to the parent company of opting for a MBO compared to a trade sale as the preferred method of divestment?

Unlock All Features of CIMAPRA19-F03-1 Dumps Software

Types you want

pass percentage

(Hours: Minutes)

Practice test with

limited questions

Support