Get CIMAPRA19-F02-1 Exam Practice Questions - Real and Updated

CIMA F2 Advanced Financial Reporting Exam Dumps

This Bundle Pack includes Following 3 Formats

Test software

Practice Test

Answers (PDF)

CIMAPRA19-F02-1 Desktop Practice

Test Software

Total Questions : 248

CIMAPRA19-F02-1 Questions & Answers

(PDF)

Total Questions : 248

CIMAPRA19-F02-1 Web Based Self Assessment Practice Test

Following are some CIMAPRA19-F02-1 Exam Questions for Review

Entity A entered into a 3 year operating lease on 1 April 20X3. The rentals are 5,000 a year payable in advance with an additional payment of $1,800 payable on 1 April 20X3.

The rental expense to be included in the statement of profit or loss for the year ended 31 December 20X3 will be:

In the year ended 31 December 20X7, FG leased a piece of machinery. The accountant of FG had prepared the financial statements for the year to 31 December 20X7 on the basis of the lease being an operating lease.

However, following the end of year audit it has been agreed that the machinery is in fact held under a finance lease and therefore the financial statements need to be corrected.

Thecorrection will have which THREE of the following affects on the financial statements?

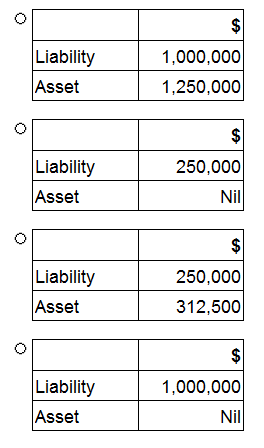

The following information relates to DEF for the year ended 31 December 20X7:

* Property, plant and equipment has a carrying value of $3,500,000 and a tax written down value of $2,500,000.

* There are unused tax losses to carry forward of $1,250,000. These tax losses have arisen due to poor trading conditions which are not expected to improve in the foreseeable future.

* The corporate income tax rate is 25%.

In accordance with IAS 12 Income Taxes,the financial statements of DEF for the year ended 31 December 20X7 would recognisedeferred tax balances of:

An entity undertakes an issue of new debt which has the effect of reducing the entity's weighted average cost of capital (WACC).

Which of the following would best explain why the WACC will have fallen?

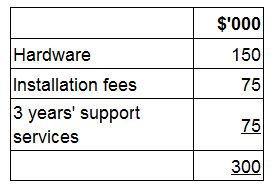

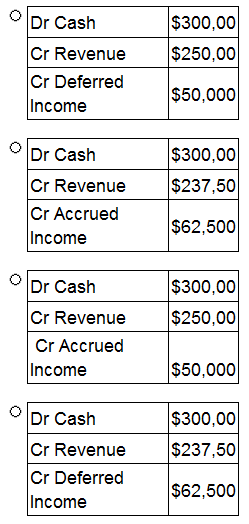

PQ entered into a $300,000contract on 1 January 20X9 to provide computer hardware to WX with support services for the3 years from the date of installation.

The contract is made up as follows:

The hardware was delivered to WX on 1 January 20X9 and installed immediately. WX paid the full value of the contract on 30 June 20X9.

What journal entry records PQ's revenue from this contract for the year ended 31 December 20X9?

Unlock All Features of CIMAPRA19-F02-1 Dumps Software

Types you want

pass percentage

(Hours: Minutes)

Practice test with

limited questions

Support