Get AICPA CPA-Financial Exam Dumps

AICPA CPA Financial Accounting and Reporting Exam Dumps

This Bundle Pack includes Following 3 Formats

Test software

Practice Test

Answers (PDF)

CPA-Financial Desktop Practice

Test Software

Total Questions : 163

CPA-Financial Questions & Answers

(PDF)

Total Questions : 163

CPA-Financial Web Based Self Assessment Practice Test

Following are some CPA-Financial Exam Questions for Review

On January 2, 1993, Quo, Inc. hired Reed to be its controller. During the year, Reed, working closely with Quo's president and outside accountants, made changes in accounting policies, corrected several errors dating from 1992 and before, and instituted new accounting policies.

Quo's 1993 financial statements will be presented in comparative form with its 1992 financial statements.

This question represents one of Quo's transactions. List A represents possible clarifications of these transactions as: a change in accounting principle, a change in accounting estimate, a correction of an error in previously presented financial statements, or neither an accounting change nor an accounting error.

During 1993, Quo increased its investment in Worth, Inc. from a 10% interest, purchased in 1992, to 30%, and acquired a seat on Worth's board of directors. As a result of its increased investment, Quo changed its method of accounting for investment in Worth, Inc. from the cost method to the equity method.

List A

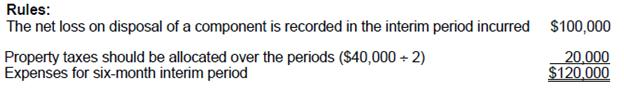

On June 30, 1991, Mill Corp. incurred a $100,000 net loss from disposal of a component of a business. Also, on June 30, 1991, Mill paid $40,000 for property taxes assessed for the calendar year 1991. What amount of the foregoing items should be included in the determination of Mill's net income or loss for the six-month interim period ended June 30, 1991?

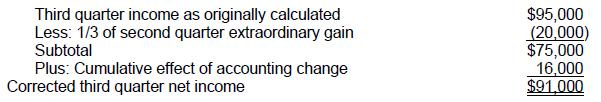

Kell Corp.'s $95,000 net income for the quarter ended September 30, 1990, included the following aftertax items:

* A $60,000 extraordinary gain, realized on April 30, 1990, was allocated equally to the second, third, and fourth quarters of 1990.

* A $16,000 cumulative-effect loss resulting from a change in inventory valuation method was recognized on August 2, 1990.

In addition, Kell paid $48,000 on February 1, 1990, for 1990 calendar-year property taxes. Of this amount, $12,000 was allocated to the third quarter of 1990.

For the quarter ended September 30, 1990, Kell should report net income of:

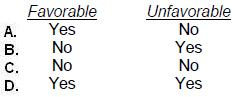

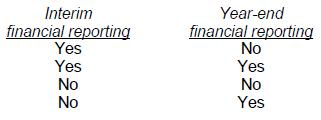

A planned volume variance in the first quarter, which is expected to be absorbed by the end of the fiscal period, ordinarily should be deferred at the end of the first quarter if it is:

Advertising costs may be accrued or deferred to provide an appropriate expense in each period for:

Unlock All Features of AICPA CPA-Financial Dumps Software

Types you want

pass percentage

(Hours: Minutes)

Practice test with

limited questions

Support