Get CFA Institute CFA-Level-II Exam Dumps

CFA Institute CFA Level II Chartered Financial Analyst Exam Dumps

This Bundle Pack includes Following 3 Formats

Test software

Practice Test

Answers (PDF)

CFA-Level-II Desktop Practice

Test Software

Total Questions : 715

CFA-Level-II Questions & Answers

(PDF)

Total Questions : 715

CFA-Level-II Web Based Self Assessment Practice Test

Following are some CFA-Level-II Exam Questions for Review

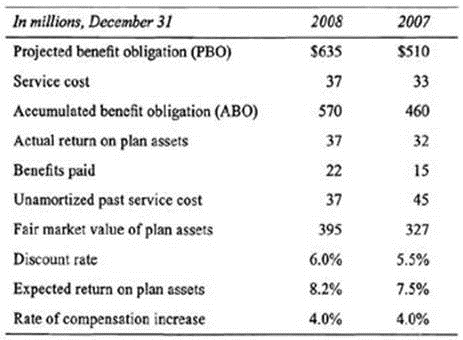

Lauren Jacobs, CFA, is an equity analyst for DF Investments. She is evaluating Iron Parts Inc. Iron Parts is a manufacturer of interior systems and components for automobiles. The company is the world's second largest original equipment auto parts supplier, with a market capitalization of $1.8 billion. Based on Iron Parts's low price-to-book value ratio of 0.9* and low price-to-sales ratio of 0.15x, Jacobs believes the stock could be an interesting investment. However, she wants to review the disclosures found in the company's financial footnotes. In particular, Jacobs is concerned about Iron Parts's defined benefit pension plan. The following information for 2007 and 2008 is provided.

Iron Parts has adopted SFAS No. 158, Employers' Accounting for Defined Benefit Pensions and Other Postretirement Plans.

Jacobs wants to fully understand the impact of changing pension assumptions on Iron Parts's balance sheet and income statement. In addition, she would like to compute Iron Parts's economic pension expense.

As of December 31, 2008, the funded status of Iron Parts's pension plan was:

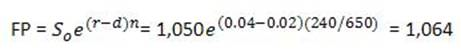

Michelle Norris, CFA, manages assets for individual investors in the United States as well as in other countries. Norris limits the scope of her practice to equity securities traded on U .S . stock exchanges. Her partner, John Witkowski, handles any requests for international securities. Recently, one of Norris's wealthiest clients suffered a substantial decline in the value of his international portfolio. Worried that his U .S . allocation might suffer the same fate, he has asked Norris to implement a hedge on his portfolio. Norris has agreed to her client's request and is currently in the process of evaluating several futures contracts. Her primary interest is in a futures contract on a broad equity index that will expire 240 days from today. The closing price as of yesterday, January 17, for the equity index was 1,050. The expected dividends from the index yield 2% (continuously compounded annual rate). The effective annual risk-free rate is 4.0811%, and the term structure is flat. Norris decides that this equity index futures contract is the appropriate hedge for her client's portfolio and enters into the contract.

Upon entering into the contract, Norris makes the following comment to her client:

"You should note that since we have taken a short position in the futures contract, the price we will receive for selling the equity index in 240 days will be reduced by the convenience yield associated with having a long position in the underlying asset. If there were no cash flows associated with the underlying asset, the price would be higher. Additionally, you should note that if we had entered into a forward contract with the same terms, the contract price would most likely have been lower but we would have increased the credit risk exposure of the portfolio."

Sixty days after entering into the futures contract, the equity index reached a level of 1,015. The futures contract that Norris purchased is now trading on the Chicago Mercantile Exchange for a price of 1,035. Interest rates have not changed. After performing some calculations, Norris calls her client to let him know of an arbitrage opportunity related to his futures position. Over the phone, Norris makes the following comments to her client:

"We have an excellent opportunity to earn a riskless profit by engaging in arbitrage using the equity index, risk-free assets, and futures contracts. My recommended strategy is as follows: We should sell the equity index short, buy the futures contract, and pay any dividends occurring over the life of the contract. By pursuing this strategy, we can generate profits for your portfolio without incurring any risk."

Evaluate Norris's comments regarding the convenience yield on the equity index futures contract and the differences between a forward and a futures contract with the same terms.

Michelle Norris, CFA, manages assets for individual investors in the United States as well as in other countries. Norris limits the scope of her practice to equity securities traded on U .S . stock exchanges. Her partner, John Witkowski, handles any requests for international securities. Recently, one of Norris's wealthiest clients suffered a substantial decline in the value of his international portfolio. Worried that his U .S . allocation might suffer the same fate, he has asked Norris to implement a hedge on his portfolio. Norris has agreed to her client's request and is currently in the process of evaluating several futures contracts. Her primary interest is in a futures contract on a broad equity index that will expire 240 days from today. The closing price as of yesterday, January 17, for the equity index was 1,050. The expected dividends from the index yield 2% (continuously compounded annual rate). The effective annual risk-free rate is 4.0811%, and the term structure is flat. Norris decides that this equity index futures contract is the appropriate hedge for her client's portfolio and enters into the contract.

Upon entering into the contract, Norris makes the following comment to her client:

"You should note that since we have taken a short position in the futures contract, the price we will receive for selling the equity index in 240 days will be reduced by the convenience yield associated with having a long position in the underlying asset. If there were no cash flows associated with the underlying asset, the price would be higher. Additionally, you should note that if we had entered into a forward contract with the same terms, the contract price would most likely have been lower but we would have increased the credit risk exposure of the portfolio."

Sixty days after entering into the futures contract, the equity index reached a level of 1,015. The futures contract that Norris purchased is now trading on the Chicago Mercantile Exchange for a price of 1,035. Interest rates have not changed. After performing some calculations, Norris calls her client to let him know of an arbitrage opportunity related to his futures position. Over the phone, Norris makes the following comments to her client:

"We have an excellent opportunity to earn a riskless profit by engaging in arbitrage using the equity index, risk-free assets, and futures contracts. My recommended strategy is as follows: We should sell the equity index short, buy the futures contract, and pay any dividends occurring over the life of the contract. By pursuing this strategy, we can generate profits for your portfolio without incurring any risk."

Which of the following types of futures markets best characterizes the observed market for the 240-day equity index futures contract?

Michelle Norris, CFA, manages assets for individual investors in the United States as well as in other countries. Norris limits the scope of her practice to equity securities traded on U .S . stock exchanges. Her partner, John Witkowski, handles any requests for international securities. Recently, one of Norris's wealthiest clients suffered a substantial decline in the value of his international portfolio. Worried that his U .S . allocation might suffer the same fate, he has asked Norris to implement a hedge on his portfolio. Norris has agreed to her client's request and is currently in the process of evaluating several futures contracts. Her primary interest is in a futures contract on a broad equity index that will expire 240 days from today. The closing price as of yesterday, January 17, for the equity index was 1,050. The expected dividends from the index yield 2% (continuously compounded annual rate). The effective annual risk-free rate is 4.0811%, and the term structure is flat. Norris decides that this equity index futures contract is the appropriate hedge for her client's portfolio and enters into the contract.

Upon entering into the contract, Norris makes the following comment to her client:

"You should note that since we have taken a short position in the futures contract, the price we will receive for selling the equity index in 240 days will be reduced by the convenience yield associated with having a long position in the underlying asset. If there were no cash flows associated with the underlying asset, the price would be higher. Additionally, you should note that if we had entered into a forward contract with the same terms, the contract price would most likely have been lower but we would have increased the credit risk exposure of the portfolio."

Sixty days after entering into the futures contract, the equity index reached a level of 1,015. The futures contract that Norris purchased is now trading on the Chicago Mercantile Exchange for a price of 1,035. Interest rates have not changed. After performing some calculations, Norris calls her client to let him know of an arbitrage opportunity related to his futures position. Over the phone, Norris makes the following comments to her client:

"We have an excellent opportunity to earn a riskless profit by engaging in arbitrage using the equity index, risk-free assets, and futures contracts. My recommended strategy is as follows: We should sell the equity index short, buy the futures contract, and pay any dividends occurring over the life of the contract. By pursuing this strategy, we can generate profits for your portfolio without incurring any risk."

Determine the price of the futures contract on the equity index as of the inception date, January 18.

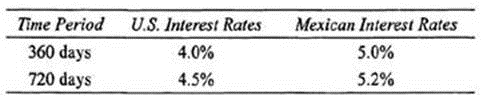

Rock Torrey, an analyst for International Retailers Incorporated (IRI), has been asked to evaluate the firm's swap transactions in general, as well as a 2-year fixed for fixed currency swap involving the U .S . dollar and the Mexican peso in particular. The dollar is Torrey's domestic currency, and the exchange rate as of June 1,2009, was $0.0893 per peso. The swap calls for annua! payments and exchange of notional principal at the beginning and end of the swap term and has a notional principal of $100 million. The counterparty to the swap is GHS Bank, a large full-service bank in Mexico.

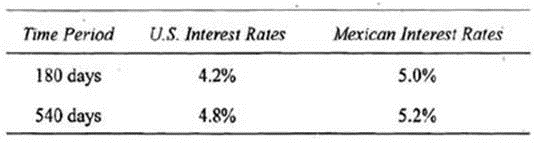

The current term structure of interest rates for both countries is given in the following table:

Torrey believes the swap will help his firm effectively mitigate its foreign currency exposure in Mexico, which sterns mainly from shopping centers in high-end resorts located along the eastern coastline. Having made this conclusion, Torrey begins writing his report for the management of IRI. In addition to the terms of the swap, Torrey includes the following information in the report:

* Implicit in the currency swap under consideration is a swap spread of 75 basis points over 2-year U .S . Treasury securities. This represents a 10 basis point narrowing of the spread as compared to this time last year. Thus, we can assume that the credit risk of the global credit market has decreased. Unfortunately, the decline provides no insight into the credit risk of the individual currency swap with GHS Bank, which could have increased.

* In order to decrease the counterparty default risk on the currency swap, we will need to utilize credit derivatives between the beginning and midpoint of the swap's life when this particular risk is at its highest. This is a significantly different strategy than we normally use with interest rate swaps. For interest rate swaps, counterparty default risk peaks at the middle of the swap's life, at which point we utilize credit derivative CQuntermeasures to offset the risk.

* Because currency swaps almost always include netting agreements and interest rate swaps can be structured to include mark-to-market agreements, we can significantly reduce the credit risk of these swap instruments by negotiating swap contracts that include these respective features. When negotiating these features is not possible, credit risk can be reduced by using off-market swaps that do not require an initial payment from IRI.

Six months have passed (180 days) since Torrey issued his report to IRI's management team, and the current exchange rate is now $0,085 per peso. The new term structure of interest rates is as follows:

Determine whether the excerpt from Torrey's report regarding the timing of peak credit risk is correct with regard to currency swaps and interest rate swaps.

Unlock All Features of CFA Institute CFA-Level-II Dumps Software

Types you want

pass percentage

(Hours: Minutes)

Practice test with

limited questions

Support