Get AAFM CTEP Exam Dumps

AAFM Chartered Trust & Estate Planner (CTEP) Certification Examination Exam Dumps

Last Updated : Apr 11, 2024

Total Questions : 472

This Bundle Pack includes Following 3 Formats

Desktop Practice

Test software

Test software

Web Based

Practice Test

Practice Test

Questions &

Answers (PDF)

Answers (PDF)

CTEP Desktop Practice

Test Software

Last Updated : Apr 11, 2024

Total Questions : 472

Total Questions : 472

$59.00

CTEP Questions & Answers

(PDF)

Last Updated : Apr 11, 2024

Total Questions : 472

Total Questions : 472

$59.00

CTEP Web Based Self Assessment Practice Test

Last Updated : Apr 11, 2024

472 Total Questions

Supported Browsers

Supported Platforms

License Options

$59.00

Following are some CTEP Exam Questions for Review

The Client wants to find out the value of estate that his spouse and each of their children would receive assuming he dies today.

Supplementary Retirement Scheme (SRS) relief for Singapore Permanent Resident is _____________ and for foreigner is ___________.

The threshold amount for tax on Net Investment Income is __________in the case of a joint return or surviving spouse, _________in the case of a married individual filing a separate return.

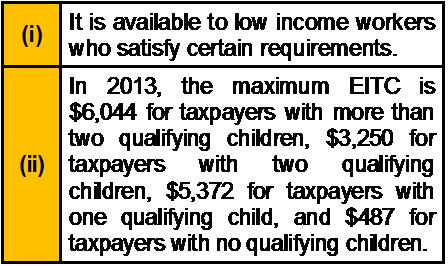

Which of the following statements about Earned Income Tax Credit (ETIC) is are correct?

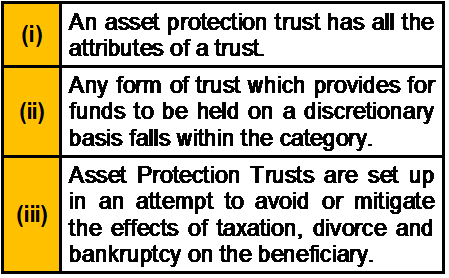

Which of the following statements about Asset Protection trust is/are correct?

Unlock All Features of AAFM CTEP Dumps Software

Just have a look at the best and updated features of our CTEP dumps which are described in detail in the following tabs. We are very confident that you will get the best deal on this platform.

Select Question

Types you want

Types you want

Set your desired

pass percentage

pass percentage

Allocate Time

(Hours: Minutes)

(Hours: Minutes)

Create Multiple

Practice test with

limited questions

Practice test with

limited questions

Customer

Support

Support

Latest Success Metrics For actual CTEP Exam

This is the best time to verify your skills and accelerate your career. Check out last week's results, more than 90% of students passed their exam with good scores. You may be the Next successful Candidate.

95%

Average Passing Scores in final Exam

91%

Exactly Same Questions from these dumps

90%

Customers Passed AAFM CTEP exam